Hello all and welcome back to another blog by Bloggie Ben. This month I will be basing my blog on Universal Credit which is known as a ‘new style’ of job seekers allowance (JSA). I will going through what Universal Credit is, how it differs to JSA and the effects it has had on people, their lives as well as sharing some statistics.

What is Universal Credit?

Universal Credit is a benefit payment which is to help those who are unemployed in the UK with their living costs. You may, in fact, also be able to claim Universal Credit if you are employed but on a low income. It is paid monthly compared to the fortnightly payment of its predecessor JSA or Job Seekers Allowance. Universal Credit came into effect in October 2013, gradually, and is still in use today.

When it came into effect, the new benefit replaced all of the following;

- Housing benefit

- Income-related employment and support allowance

- Income-based job seekers allowance

- Child tax credit

- Working tax credit

- Income support

How it works

Universal Credit works very differently compared to the older benefits, so its important to know the differences. The biggest differences are as follows;

- You can get Universal Credit if you’re unemployed but also if you’re working

- You’ll usually get a single payment each month, rather than weekly or fortnightly

- Instead of getting a separate housing benefit, your rent will usually be paid directly to you as part of your monthly Universal Credit payment

You’ll usually get one monthly payment to cover your living costs. If you claim Universal Credit as a couple, you and your partner will get one payment between the two of you. The payment is made up of a basic ‘standard allowance’ plus any extra payments that might apply to you, depending on your circumstances.

You might be able to get extra payments if you:

- Look after one or more children

- Work and pay for childcare

- Need help with housing costs

- Are disabled or have a health condition

- Are a carer for a disabled person or you have a disabled child

You can check your eligibility, or how much you could claim and more via the Government website – https://www.gov.uk/universal-credit/

If your Universal Credit payment includes help with rent, you will usually need to pay your landlord or landlady each month from the Universal Credit money you receive, even if you live in social housing. You can ask the Department for Work & Pensions to pay your rent directly to your landlord if you are in debt, have rent arrears or are struggling with money.

As stated previously, you can even claim Universal Credit if you are employed and on a low income. The amount of Universal Credit you get will change depending on the amount of money you receive from the job. For example, the more money you receive from your work the less Universal Credit you will receive. If your hours are reduced or you lose your job the Universal Credit will rise. For every £1:00 you earn 63p will be taken from your Universal Credit amount. A benefits calculator is available for you to check how your payments may be effected by your job – https://www.gov.uk/benefits-calculators

When first claiming Universal Credit, it can take up to 5 weeks to receive your first payment. This seems daunting as it is a long period to go with no income. Many people who are employed are, usually, paid once a month.

However, if you do feel that you do not have enough to see you through until ‘pay day’ you can request an advance on your payment, although this is not guaranteed to be accepted. Once you receive your first payment you will then be paid monthly from the same date as the first payment i.e. 23rd of each month.

For those than are self-employed and claiming Universal Credit you will be required to report your earnings for each month before you can receive any payment from Universal Credit.

The Department of Work & Pensions (DWP) will not remind you to report your earnings, this is your responsibility. Earnings should be reported for each month. The DWP will then calculate your Universal Credit payments – this is called an ‘assessment period’. Your assessment period usually starts on the same date each month: starting one calendar month after the date you submit your claim online or over the phone. You can report your earnings for the month from 7 days before and until 14 days after the end of your assessment period.

An example of this is as follows – Ruth claims Universal Credit on the 8th November. Her assessment periods start on the 8th day of each month. Her first assessment period runs from 8th November to 7th December. She must also report her earnings for this period to the DWP between 1st December and 21st December.’

If you cannot report your earnings on time you will need to have a good reason why. For example, if you were admitted to hospital at short notice and no-one else had access to your accounts. If you don’t have a good reason, the DWP will usually stop your Universal Credit claim until you report your earnings. Contact the DWP as soon as possible to explain why you’re reporting your earnings late.

You can call DWP for free to inform them of late payments or any other information you wish to discuss.

Working Out Your Earnings

You will need to add up all the income your business has received during the assessment period – these are called ‘receipts’.

Then take away amounts you’ve spent on your business – these are called ‘personal allowances and permitted expenses’. This will give you your final earnings amount.

Personal allowances

You’ll need to deduct the following off your earnings:

- income tax – if you’ve paid any that month

- National Insurance – if you’ve paid any that month

- pension contributions you make

Permitted expenses

You should take away amounts you’ve spent on reasonable expenses for your business. These might include:

- stock or equipment

- rent for business premises, office or storage space

- insurance – such as liability or buildings insurance

- repayment of interest on a loan – up to £41 a month

- VAT

Costs of a vehicle

You can deduct expenses for the costs of a vehicle you use for your business. The amount you can deduct depends on the type of vehicle you use.

If you use a car for business, you can deduct a fixed amount for each mile you travel for business – this is called a ‘flat rate deduction’.

If the vehicle isn’t a car – for example, if it’s a van or motorcycle – you can choose to deduct either:

- flat rate deductions

- the actual expenses of buying and using the vehicle – including petrol, servicing, repairs, insurance and MOT

Flat rate deductions are 24p per mile for a motorcycle. For other vehicles they’re 45p per mile for the first 833 miles then 25p a mile after that.

If you use your home for business purposes

You will also need to deduct expenses for the use of your home using flat rate deductions. The amount of the deduction depends on the number of hours you have spent working from your home during the assessment period.

For example;

| Hours spent working from home during assessment period | Flat Rate Deduction |

| Between 25 – 49 hours | £10 |

| Between 50 – 99 hours | £18 |

| More than 100 hours | £26 |

Reporting – Online Account

All people that are claiming Universal Credit will have what’s called an ‘online journal’ that is accessible via their online login which will be set up for them when they first claim. There is a lot you can do with your online account/journal;

You will use your online Universal Credit account to:

- Keep a record of the things you’ve done to prepare or look for work

- Send messages to your work coach and read messages they send to you

- Report a change of circumstance

- Record childcare costs

- Provide details about a health condition or disability

- See how much your Universal Credit payments are

- Check what you have agreed to do in your Claimant Commitment

You can also report your earnings via the journal if you are self-employed.

Once you have reported your earnings the DWP will check your earnings amount and whether the minimum income floor applies to you. Then they’ll work out how much Universal Credit you should get paid for the assessment period. The DWP aim to pay you within 7 days of the last day of your assessment period.

Things you need to do whilst on Universal Credit are set out in a ‘to do’ list on your online account. This could be about completing your claim, or things that you have agreed to do as part of your Claimant Commitment.

When you complete one of these tasks it will move from your ‘to do’ list to your ‘journal’. Your journal is your record of everything you’ve done whilst claiming Universal Credit.

If you are required to look for work, you will set up an account on a website called Find a Job. You can use this site to look for work and keep a record of some of the things you’ve done to find a job. You can also find tips and advice about working, CVs and interviews on ‘The Daily Jobseeker.’

Online conversations

You can also use the journal to, once again, send messages to your work coach, and they can use it to reply or send their own messages to you. These online conversations will be stored here so that you and your work coach can look back to see what you have discussed and agreed.

You should use the journal to tell your work coach about things such as job applications, job interviews and any training you have done. You can also use it to ask them questions. If your work coach has something, they want to share with you – such as a CV you have been working on together – this will also be stored here.

Payments

Your online account will also show your Universal Credit payments. It breaks down your payment, so you know why you are getting that amount. For example, if you are getting payments to help with housing or childcare costs, or if money has been taken off to pay back an advance.

Your payment will usually be shown a few days before the money is available in your chosen account.

Statistics

Statistics published on 14th June 2018 show that there were around 980,000 claimants on Universal Credit alone. This had risen by 7% from May 2018 and shown an increase in claimants of around 400,000 since June 2017. Of the 980,000 people claiming Universal Credit, 37% (360,000) were in some sort of employment i.e. self-employed / part-time. This is a 1% decrease since June 2017. Of the claimants they were split 50/50 between male and female. In June 2017 41% of the claimants were female seeing a 9% increase.

Nearly half of the people who were claiming Universal Credit are were actively seeking a new job by searching for work including around 250,000 males & 250,000 females. Around 200,000 claimants were currently working with no further requirements from the DWP, but around 100,000 of these were in employment but still had requirements to meet to claim their Universal Credit.

Around 150,000 claimants had no work requirements as they were unable to work due to disabilities etc. Around 15,000 were planning for work, with a further 15,000 preparing for work whilst claiming Universal Credit.

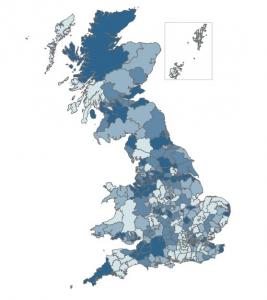

The image here of the UK, shows where Universal Credit was claimed most between the period of June 2017 – June 2018. The darker the colour the more claimants.

You can also see a more updated version by region at the following link;

http://dwp-stats.maps.arcgis.com/apps/MapSeries/index.html?appid=f90fb305d8da4eb3970812b3199cf489

85% of claimants are receiving their payments regularly, where only 15% don’t due to not meeting requirements set by the DWP. The average amount of credit paid to households is £650.00 per month.

Single parents on average receive £950.00. A couple with a child or children will receive around £930.00. A couple with no children will receive around £640.00 and an individual will receive around £470.00 per month.

Real-Life Stories

In this section of the blog, we now will take a look at some real-life stories about Universal Credit and the effect it is having on lives of some claimants. Please do take the time to read each of them. The blue text is a hyperlink leading you to each of the stories.

Universal Credit is a major factor behind England’s mental health crisis – The Big Issue

Universal credit claimants driven to consider suicide over stress caused by welfare reform – The Independent

Struggling NHS cannot cope with added pressure from Universal Credit – Coventry Live

“I’ve nearly lost my house twice” – BBC

Dad, 34 took his own life after Universal Credit left him with £4.61 – Metro

Families on Universal Credit pushed into poverty – The Sun

The misery, despair and pain of Universal Credit – The Guardian

Nurse sells her children’s toys in order to buy food – The Sun

Video – Universal Credit Scam: Jade’s Story – BBC

How Can We Help?

Are you currently claiming Universal Credit, or a similar benefit yet cannot find a job? Do you lack self-esteem and suffer with low confidence? The AoC can help!

We can offer 1-1 individual or couple therapy sessions to you to help build self-confidence and self-esteem, to help you feel more comfortable when applying for jobs and conducting interviews.

We are also here to support you speak to if Universal Credit has you stressed, depressed or anxious. We have professional, qualified counsellors and therapists ready and waiting to offer their support in Central Dudley, West Midlands. We can also provide counselling by telephone or online video such as Skype.

A referral form will need to be competed in order for sessions to begin, and this can easily be downloaded from our website – www.theaoc.org.uk or you can simply request one to be sent to you by email or post.

Please use the details below to contact us.

We also run a 3-day employability course known as EMPOWER.

We are helping residents living in Dudley and surrounding area gain long term employment by creatively exploring personal barriers to getting and/or maintaining work.

Course Overview:

In this three-day course we will help and guide you to:

- Turn your life around

- Nail that next job

- Raise your confidence

- Become motivated

- Learn to work in teams

- Break barriers to employment

- Meet local employers

- Get a certificate of completion

If you would like more information about either of the services please do not hesitate to contact us by calling us Monday – Friday between 9:00am – 4:00pm on 01384 211 168 or emailing us on support@theaoc.org.uk

If money constraints have also caused a rift between you and your partner or ex-partner and this has disrupted your children’s family life, we can also help. The ACC Contact Centre based in central Dudley can offer contact sessions that are affordable for all.

We provide a supervised and supported contact centre for children to be able to see their non-resident parent(s), and other non-resident family members. ACC offers a professional, safe, caring and supportive environment in the heart of Dudley Town Centre, West Midlands.

Our contact centre is open daily and during evenings and weekends.

ACC is affiliated and regulated by the National Association for Child Contact Centres (NACCC) which ensures all out staff team and volunteers are fully trained and provide best practice and quality for all children and you.

For more information please call us on 01384 211 168 or send an email to support@acccontactcentre.com

We look forward to supporting you.

My Views on Universal Credit

I have never claimed Universal Credit. However, there was a time when I left college and I was unemployed when I claimed Job Seekers Allowance (JSA) whilst actively seeking my first job. I was very reluctant to ‘sign on’ and claim the benefit as I was confident in myself that I would find a job after leaving college, and with three distinctions. I was proved wrong. I struggled to find employment through lack of experience. So, I eventually started claiming JSA, and sought the help of the job centre.

Putting it lightly, I absolutely hated the place. I dreaded going there every two weeks to sign my documents and claim my money, after extensive job searching which was a requirement. The amount of people I spoke to who faked their job search was baffling. I felt so uncomfortable going there with certain people who had no intention of working. Just collecting their benefits to spend on beer and God knows what else.

I believed l was in that group who genuinely wanted to find work and improve myself but felt I did not receive adequate support from the Job Centre at all. They did very little to help me find a job, or helped my interview techniques or even my CV. I don’t recall them ever viewing my CV.

It’s easy to see why so many are claiming the benefit with no intention of finding work. I feel this because the advisers do not really check if work searches are being completed correctly and do not spend anytime with claimants to know otherwise. This makes it easy for claimants to forge their work searches and still receive their payment each month. I have come across plenty of people who are still doing this today.

I found that when they did try to support me, that it wasn’t really helping they would put me forward for jobs inappropriate for my skills or level of experience. I wanted to make use of the qualifications I worked hard for; throughout college (business studies), but here I had my adviser putting me forward for jobs as a fishmonger, no joke.

I had clearly stated, when first claiming JSA, that it was administrative work I was seeking. I felt as if the advisers at my job centre could not care less what I wanted to do, as long as they were (putting this lightly) doing theirs.

Thankfully, the job centre passed me onto an organisation called In-Training (less work for them) who helped a lot more reviewing of my CV & putting me onto free courses to improve my interview techniques, as well as gaining a few qualifications to help toward jobs I applied for. They found me a voluntary position doing administration and, hey ho, here I am today in the same role but now both paid and working full time.

I cannot stress enough how important it is to volunteer just to gain some work experience, if you are struggling to secure paid employment because you never know where it may lead onto.

JSA is the closest to Universal Credit I have, personally, claimed. However, after researching some of the shocking stories earlier mentioned, it’s obvious to see that a lot of the genuine claimants who need support are struggling.

A nurse, who is working – as well as being a parent, having to sell their children’s toys to fund food is not right and something needs to be done to help these families.

I think DWP are also playing a dangerous game giving the Universal Credit payments in monthly lump sums: including the claimants rent etc. I feel a lot of this money could be wasted on alcohol and drugs by those who do not seek work, and as a result, rent and other essential bills will go unpaid, putting them in more debt.

I understand that this is the individual’s responsibility, but I feel that giving them this money to do as they please is the wrong choice. In my opinion they should go back to the old system, where claimants were given their money for all food and other living materials, but their rent and other bills were paid automatically to the landlord or landlady. This way they would not be out of pocket, caused by rent not being paid and a roof would be kept over the claimant’s heads.

As we know mental health issues are at an all time high at the moment, and it’s appearing more and more in the media. Universal Credit has had such an effect on some people’s health that it’s made them suicidal and, in some cases, people have taken their lives due to the small amounts of money they have been expected to survive on.

I feel this system should be reviewed by the government as it cannot go on making people stressed to the point where they self-harm or take their own life.

A family I know of are currently on Universal Credit, and they explained to me how little they receive due to other benefits they were entitled to being stopped, and for reasons that have not been explained properly by DWP. They were also given very short notice. Consequently, they could not save and have been left struggling and extremely anxious and worried. They have an autistic child to care for and both parents are working part time, but feel they are receiving no real support from DWP.

My relatives have had to borrow money to buy meals and shopping and have no social life, due to their low-income and support from Universal Credit, although both are working all hours currently available to them.

Thank you for taking the time to read my blog on Universal Credit. If you have any comments or would like to share your feelings, views and/or stories regarding Universal Credit please feel free to comment below.

Bloggie Ben.

September 2019.